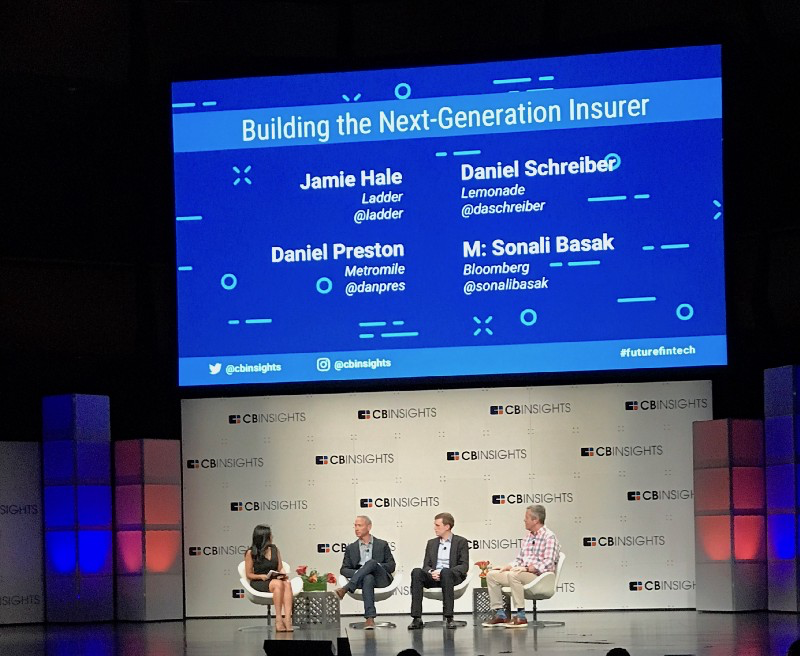

I recently attended the Future of FinTech Conference in New York. Among the plethora of panels and presentations delivered, the insurance technology content was most enlightening. According to CBInsights, the conference host, more than $7 Billion (620+ deals) has been invested in insurance technology (aka insurtech) since 2012. Let that sink in for a moment…

That’s more than the GDP of Greenland! The insurance industry has never seen this level of investment or momentum focused on its transformation. There are more than 1250 companies, globally, working on insurance software, data analytics solutions, new full stack tech-enabled insurance carriers, and digital distribution companies. The source of this capital is a mosaic of traditional venture capital firms, insurance corporate VCs, strategic investors and hedge funds. Some of the capital above is smart about insurance, and some are not. I am not one to make predictions, but I can’t help but do so here.

I predict that (1) At least 50% of these companies will fail in their mission, (2) more than half of the money invested will be turned into zero, and (3) there will be a profound change in the insurance industry that results from the winners.

Nevertheless, I sincerely wish the founders the very best and would like to offer some advice to the “newbies” from my learnings over the past decade as an insurtech CEO.

I specifically geared this advice to CEOs of those companies developing B2B Software for carriers and brokers in the space.

1. YOU’RE DEALING WITH RISK MANAGERS, NOT RISK TAKERS.

One of the most important lessons I learned from one of my mentors is the importance of “the lens.” The concept says we all look at the world through the prism of our profession (or passion). If you are a lawyer, you see things from a legal perspective. If you are an educator, you see things from an educational point of view. If you are in the cyber-tech business, it’s all about security. You get the idea. Insurance is no different. If you want to understand how your potential customers think, think risk management. Insurance is a highly-regulated industry. Many of these companies have taken years to get to a point where there is trust in their brand from both the insured and the regulators. Therefore, they view every new investment through the lens of managing risk. No company will invest in a new technology (even as an early adopter) without thoroughly mitigating all known risk, and planning for unknown ones. At times, you will spend countless hours navigating your way through a labyrinth of reviews and evaluations, wondering why. Don’t despair. Your clients must fully underwrite your product and company before taking on the risk. So, if your product or service is looking to transform a core operation, think about the risks you introduce to the potential customer.

2. BE PATIENT AND BE PERSISTENT.

Building a tech business in the insurance space is not for the impatient. It’s all about speed. In the universe, Einstein’s law explains that nothing travels faster than the speed of light. Well, there is a similar observation in insurance; nothing can exceed the velocity of insurance decisions. And, decisions do not happen quickly in the business of risk. Be sure to calibrate your business execution and strategy to address this. If your solution delivers value, they will eventually see it and adopt it. However, don’t hold your breath. It will feel like a long hiatus until sales take off. You should expect to take 3–5 years on average before your sales growth resembles a hockey stick. The first few years will be slow going. Build a close relationship with the visionaries and early adopters in the industry. Develop a go-to-market approach for finding them. Remember, there is a chasm between these first devotees and the mainstream market. Navigating that divide takes time. Do so one niche at a time.

“… [insurance] is huge, unchanged, unloved, making it interesting.” — Daniel Schreiber, Founder, and CEO of Lemonade Insurance.

3. CONSERVE CAPITAL.

Be very careful with your cash. There is plenty of venture money coming into the industry right now. Many of the players have no experience with this industry. This greenness could be both good and bad. The good thing is, professional capital providers are running to participate in an inevitable windfall in what is likely a bubble. The bad thing is that many don’t have pattern recognition. So, when things get tough, they will be impatient and won’t be empathetic. The best strategy is to conserve your cash and manage your operation tightly until your market matures. “Going big or going home” does not work so well in the insurance technology field. Focus on religious market education and adoption plans, skipping over other strategies. That will be important as the market fully “gets” the value of your solution. One more thing. Don’t make your ability to raise capital your measure of success. Make customer success on your solution that measure. Raise as much funding as you can and husband it.

These lessons are intended to help entrepreneurs new to insurance avoid “unoriginal” mistakes as they develop their insurtech ventures. If they work for you, drop me a line or comment below. I want to hear from you!

Please continue to part II, where I share advice on the insurance community, customer relationships, and sales.

Download a copy of the e-book version of this popular blog series here. (It includes five bonus lessons.)

About the Author

John Belizaire is CEO of Soluna, a serial entrepreneur, advisor, and investor. He is also the editor of CEOPLAYBOOK.IO — a medium publication (thoughts expressed here are solely those of the author.) Connect with him on LinkedIn and Twitter. To get the popular newsletter, Mental Candy sign up here.