This is the second article in a series of blogs by Mike McKeee aimed at sharing many of the lessons he has learned helping technology companies move “onwards and upwards” over the last two decades. Thank you so much for the feedback and comments on First Principles, Part 1, “Seek Advice Early and Often”, as well as the suggestions for other related topics to cover.

Despite it being one of my favorite classes at Harvard Business School–taught by one of my favorite professors, Ben Esty–there is only one thing I remember from my second-year Corporate Finance class.

The very simple answer to the essential question, “What is the only reason that businesses fail?”

Answer: they run out of cash. Full stop.

When I started at ObserveIT in March of 2016, Bain Capital Ventures was good enough to stick by their Series A investment and put in an additional $5M as part of a “Series A prime,” the code name for things didn’t go exactly as planned, but we’re not throwing in the towel quite yet.

The company had burned through all of the Series A money and drawn down a $3.5M line of credit, but the principal payments on the debt weren’t starting for a couple of years, and the company had downsized from 140 to 100 employees, thereby reducing the burn to about $5M per year. So, I figured I had twelve months to point the business in the right direction and raise more money.

In keeping with my First Principle, Seek Advice Early and Often, I decided to test my thinking with a long-time friend of mine, Jasper Malcolmson, who had worked at McKinsey, Yahoo (in the good times), and then founded an e-commerce business which he sold to JPMorgan Chase.

His assessment of my situation was a little different than mine: “You’re F*^ked!”

After a somewhat awkward silence (rare for me), while I sunk deeper into the couch in his dark San Francisco apartment, he continued, “It takes six months to figure out what is going on, it takes six months to start making changes, and it takes six months to raise money. And if you believe the old adage that things always take longer than you expect, those are optimistic assumptions!”

Ahh, it’s always so great to catch up with high school buddies.

In less than an hour, my mental model and outlook for the business, which I had just taken over a week prior, had completely changed. It was suddenly very clear that I had to construct a model that gave me at least two years to turn the business in the right direction, and the model had to have highly realistic/conservative bookings assumptions.

Unlike the “What is our strategy?” question, which I couldn’t answer for months, I was able to answer the question, “What are we going to do with the $5M we just received” very clearly by the end of my first week: “Nothing, we’ve already spent it. All of our expenses are walking around on two feet.”

Then, I made the tough decision to let go of almost half the people in the Boston office in my third week, thereby continuing the streak of “red weddings” that had been going on for months.

While this was an extremely tough way to start a new position in a new office with new colleagues, we needed more cash and time.

Also, the company had been ramping sales heads to meet the desired bookings in a spreadsheet, not based on actual sales success. Salespeople need to be making money before you scale. Businesses should scale because demand is going up, not because of theoretical assumptions in a spreadsheet.

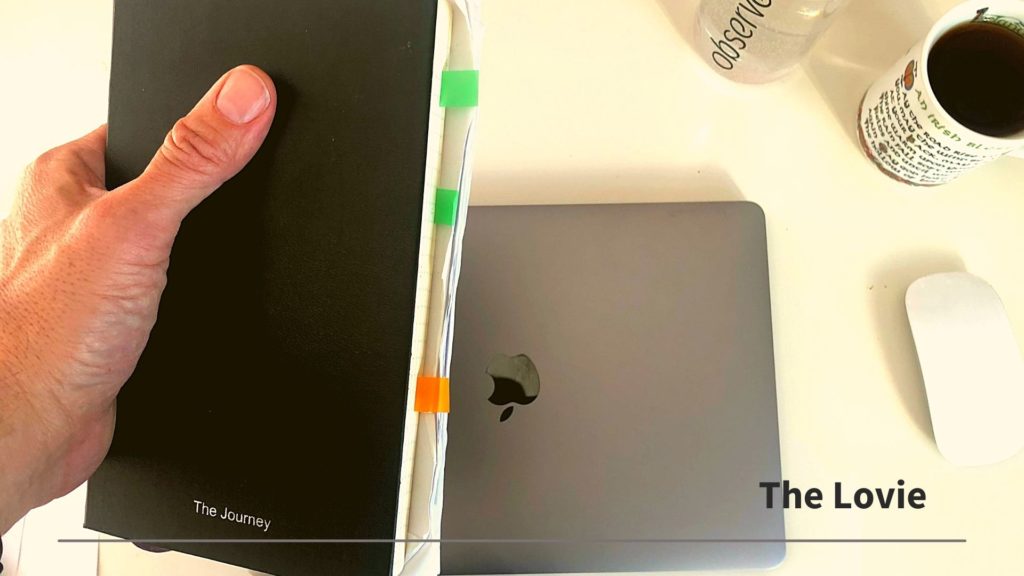

For the next four years, I carried a one-page, 12-quarter cash model (past 4Qs, next 8Qs) in the back of my Moleskine notebook wherever I went. I knew exactly where we were tracking on cash for the month, quarter, and year at all times. The joke was that this one-pager was my “lovie,” a term normally reserved for the stuffed animals carried around by my kids.

When we were raising money, I would have two lovies: a base case model and an upside model (assuming we raised more money) or Vader and Skywalker, as we sometimes called them. At all times, we knew we had enough money for the Base Case or Vader.

And we were paranoid!

After paying back our term debt, we opened up another credit line that I called the Trump Fund, i.e., if something crazy in the world happens, we still had millions to draw on.

(I’m giving away my political leanings here).

Now let me tie this back to the First Principle, Always Selling, Always Recruiting.

There are only a handful of ways to get money: raise it from investors, borrow it from creditors or sell software and services.

Selling software and services is by far the most fun.

(The “Rules of the Fundraising Road” will be covered in future First Principles articles.)

The “realistic bookings assumption” in the model was only realistic if I myself was committed to selling — attending low probability prospect meetings, doing demos, building decks, participating in Proof-Of-Concept readouts — and if the whole organization realized how the bills were paid and their paychecks were funded.

Building relationships with customers (people buy from people they like and trust), finding the customer pain (think aspirin, not vitamins), qualifying deals (time is your most scarce commodity), and closing deals (always be closing) is hard and takes time, but the truth lies with the customer, not in office conference rooms. Leaders need to be in touch with the truth. Getting a customer to cut a check for something is the only way to know you have something real and pay the bills.

Now that I have answered the question, “What is the only reason businesses fail?” let me turn to, “What is the only reason businesses succeed?”

Answer: People.

Getting great people is so hard, takes so long, and is a perpetual process given that needs are constantly changing, and you’ll make hiring mistakes.

When I started, I treated the backfilling of the 75% of the management team that had been fired as a checklist process. Just go down the list, get a head of Sales, a head of Marketing, a head of Finance…

Bad thinking!

I got some hires right, I got some wrong, the 25% of the management team still remaining weren’t all the right people, and the business needs were constantly changed.

Building the right team is an ongoing process.

One of my strengths was admitting my hiring mistakes and very respectfully and very fairly, I hope, trying again.

If the fit isn’t right, both sides usually know it, and it’s best to move quickly for everyone involved. 19 times out of 20, people wish they made the tough move sooner, not later.

Getting rid of the people when the fit isn’t right is as important, if not more important, than getting the right people.

One of my favorite sales truisms is: one-third of deals will come in, one-third will get pushed, and one-third will blow up.

The exact same adage applies to recruiting. Never be single-threaded on a candidate and never stop recruiting because you think you’re getting close with the right person. One-third of the time, the finalist will be right, one-third of the time the timing isn’t right, and one-third of the time, you’ll get it wrong. Accept it.

Another one of my favorite sales expressions is, “the person with the biggest pipeline always wins.” The exact same adage applies to recruiting. Always be networking. Always be keeping a list of great people with whom you’ve worked or heard about from trustworthy sources. Always be interviewing.

The really hard part about recruiting is that it isn’t very fulfilling, and it isn’t very efficient.

Knocking things off your daily list and dealing with problems right in front of you is so much more satisfying. Getting to know a candidate, telling the company story, comparing notes with other people, doing a second round, taking the person out for casual interaction, doing back-channel checks–is grueling! And the vast majority of the time, you get to the end of the process, and it’s not the right person.

As this grind continues, the risk of settling increases.

Much like marriage, never settle!

Similarly, never squint! Sometimes candidates look good when you squint, but if you remove the furrow from your brow, they don’t look so good. Be honest with yourself through the entire process.

It is always worth waiting. If you’ve got the right person, but they can’t start for a few months, wait.

Lastly, let the fires burn.

It is always so tempting to spend time doing the work for the person you want to hire, filling the holes, trying to get their job done. But to do that means to take time away from recruiting, which means you’ll perpetually be treading water.

There is no bigger accelerator to a business than getting a great person. I coach kids hockey, and we’re always in search of “difference makers.” The right person is a difference-maker and lifts their functional area and the entire organization.

A leader’s primary job is to “stack the deck.”

There is only one reason businesses succeed: they recruit, develop, motivate and retain great people. Make sure to devote sufficient time to recruiting, and don’t run out of cash!

Always Selling, Always Recruiting.

Onwards and Upwards!

Mike

P.S. Thanks again for the feedback on First Principles, part 1: “Seek Advice Early and Often.” Please share with others you think will benefit. Please keep the feedback coming along with suggestions for more topics to cover. I’ve got lots of stories/battle wounds to share!

About Mike McKee

Mike is the Founder of Onward & Upward Consulting — an advisory firm focused on helping CEOs and functional leaders master the First Principles of growing a venture-backed company. Mike founded the firm for two simple reasons: he was the beneficiary of so much great advice at PTC, Rapid7, ObserveIT, and Proofpoint that he wanted to share it with as many people as possible so that more people will hopefully experience the excitement, challenge, learning, fulfillment, and joy that comes from taking a company from point A to point B; and secondly, Mike plans to be a CEO again so wants to stay connected with as many great people as possible (spoiler alert: “Always Selling, Always Recruiting” is the next article in this First Principles series).

Mike has over 25 years of cross-functional, global experience in technology, most recently as EVP and GM at Proofpoint. Before joining Proofpoint, Mike was the CEO of ObserveIT, which got sold to Proofpoint in 2019. His previous roles include leading award-winning Global Services and Customer Success organizations at Rapid7, SVP of Services and Strategy at PTC, CFO at HighWired.com, and Financial Analyst at Goldman Sachs. Mike played professional hockey for the Quebec Nordiques (now the Colorado Avalanche). He graduated cum laude from Princeton University and received an MBA, with honors, from Harvard Business School.